Equity Update

On March 9th, the bull market turned seven but there was little celebration as 2016 was shaping up to be one of the worst starts to a year, ever. Broad macro concerns resurfaced to start the year with large cap stocks down -10.3% at the February low before rebounding sharply and finishing the quarter at +1.3%. Volatility has been largely driven by oil price movements as well as concerns of a China hard landing, yuan devaluation, and other geopolitical concerns such as the sustainability of the European Union. International developed equities were not as fortunate with the MSCI EAFE finishing the quarter down -2.9% among negative interest rate policy (NIRP) in Europe and Japan intended to stimulate economic activity. The MSCI Emerging Markets index bounced back off of lows finishing the quarter at +5.7% aided by stronger commodity prices, a drop in the U.S. dollar, and lower expectations for future U.S. rate hikes.

From the chart below we can see that the market has been trading in lockstep with the price of oil over the short-term. We view a stabilization of the price of oil in the $40-$50 range as still beneficial to the consumer while easing pressure on the energy companies which make up a considerable portion of the market.

Overall, the U.S. economy appears to be in good shape and is arguably the healthiest economy in the world right now. Job growth has been solid, auto sales and housing have been strong, and 2016 government stimulus should add .6% to GDP. While this seven year bull market has been tested recently, investors are left with same dilemma - lack of viable alternatives to achieve investment return.

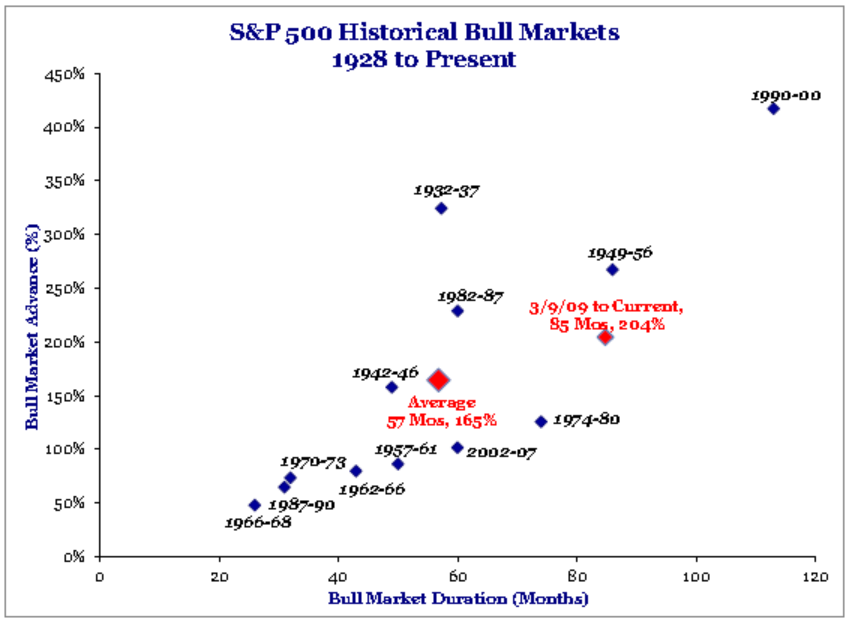

From a historical perspective, this bull market is the third longest in duration as can be seen from the chart below. Based on current economic factors, we feel that the cycle still has room for growth. Typically, bull markets are killed off by rising real interest rates, inflation, excessive speculation or black swan events. While black swan events are difficult to forecast, the other three factors are still a tail wind for stocks.

Source: Strategas

We believe the chance of a recession over the next year is low but recommend a diversified portfolio as the best way to weather market volatility and achieve long-term investment goals.

Fixed Income Update

The Barclays US Aggregate posted a gain of 3.03% in Q1 and the Intermediate index gained 2.31%. The gains were a result of falling rates due to concerns of slowing global growth, overall financial stability of world markets and negative interest rates in overseas bond markets.

While rates increased in Q4 of 2015 leading up to the Fed's December meeting, the market view of the Fed's decision to raise short term rates by 0.25% in December 2015 was that it was premature. The bond markets took a short hiatus after the Fed December meeting but then as the New Year turned, yields sank again. The flight to safety from risk assets was fully in play and the spreads on high yield escalated in lockstep with the falling equity prices, especially in the energy market sector. The market reaction along with weakening data seems to have given the Fed some pause on the rate of increase as indicated in their rate forecast "Dot Plot", which now shows 2 increases in 2016 whereas the December version included 4 increases in 2016. However, the market is showing that even 2 increases in 2016 is too much as shown in the probability of increase for each Fed meeting throughout the balance of the year shown in the chart below.

In the credit markets, spreads in investment-grade and high-yield spreads moved higher and together throughout the quarter, as seen in the chart below, and like equities, showed increased market stress in the middle of the quarter only to return to the starting point by the end of the quarter. The wider spreads provided a short time window for buying and serve as a reminder of what happens in credit markets during times of stress and that higher quality issues provide the most stabilizing diversification in an overall portfolio context.

Source: Northern Trust Investment Strategy