Equity Update - Mark Evans, CFA

Despite weak corporate earnings, the equity markets continued to advance in the third quarter. The S&P 500 gained 3.9% while small-cap stocks performed even better as the Russell 2000 advanced 9%. Technology stocks led the market climbing 12.9% for the quarter while Utilities and Telecom, which performed very well in the first half of the year, fell -5.6% and -5.9% respectively.

While this bull market is relatively old, there are no immediate signs that it is over yet as we continue to see signs of a classic wall of worry. Stocks have advanced 218% off the March 2009 low and have gone 88 months without a 20% pullback yet this is the most distrusted bull market in history. We continue to see net redemptions in equity mutual funds and ETFs, modest merger and acquisitions, and almost non-existent IPO activity. The market sentiment is being driven by fear and skepticism rather than greed. Given that real interest rates are extremely low and corporate credit spreads are well behaved, these are highly unlikely conditions for a bear market phase to begin. Additionally, the earnings outlook for 2017 looks to be much brighter as the earnings recession from energy companies will be behind us.

While we are entering the seasonally strong fourth quarter we are also entering a critical period in a Presidential election year. Typically, the fourth quarter is the best performing quarter for the stock market averaging almost 3% since 1928. Since 2009, the seasonal tail wind has been even more pronounced with an average gain of over 6%. However, countering this positive influence is a contentious open election. Open elections have on balance not produced such favorable returns. We are currently within a critical period when stocks focus on the election. In the three months ahead of the elections, the S&P 500 has predicted 19 of the past 22 elections. If stocks were higher in this three-month window, the incumbent party wins while the opposition party typically wins if stocks are lower. As of 9/30, the S&P 500 is slightly down at -.24% (since 8/8). October will be a critical test period. Further, the one-month performance of the market after the first debate is even more pronounced in open election years. This trend is evident from the chart below: a negative market favors the opposition party while a positive market favors the incumbent. Lastly, a relief rally typically occurs in the stock market after a presidential election regardless of the outcome.

Fixed Income Update – Rick Sasala, Ph.D., CFA

The Barclays US Aggregate posted a gain of 0.46% in Q3 which brings the YTD return to 5.80%. The Intermediate Aggregate index gained 0.31% in Q3 and 4.10% YTD. The Q3 gains were primarily from coupon payments as well as some narrowing of spreads, as rates overall were much more stable than the beginning of the year when yields fell significantly and produced most of the YTD returns.

The table below summarizes the quarterly yield moves for various treasury bonds as well as the yield change on an YTD basis. Both the Y/Y and YTD numbers show a flattening of the curve since the longer maturity bonds have decreased and the shorter bonds have either remained the same or increased. Typically, long-term treasury yields are reflective of a combination of long-term growth and inflation expectations. Both of these are expected to be in the range of 2%, which indicates that there are other influencing forces which continue to put downward pressure on rates.

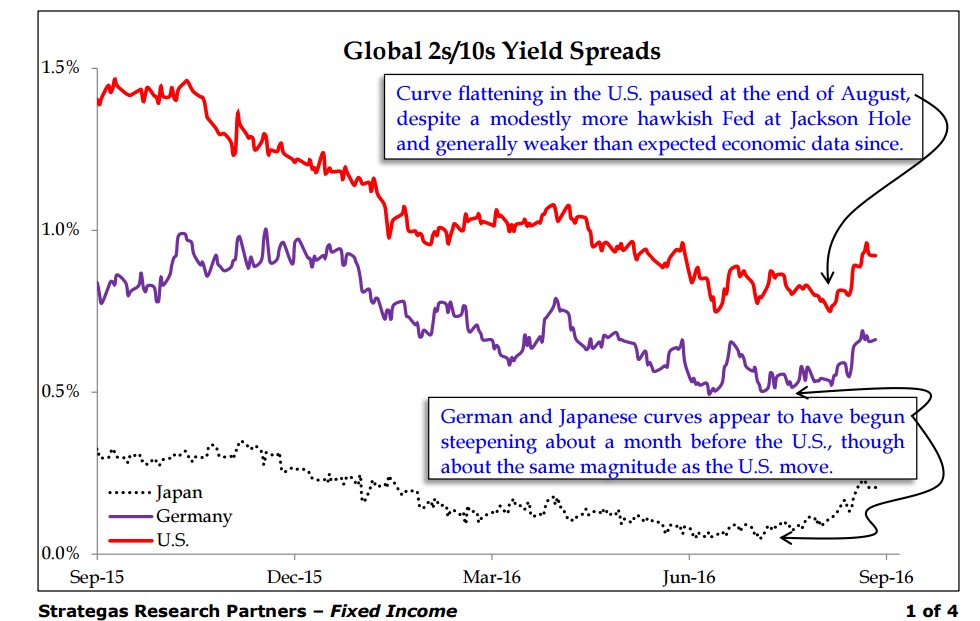

While there continues to be much conversation and speculation about if, when and how the Fed will increase rates next, it is the international market over which the Fed has no direct control that has been a significant driver of the fixed-income markets this year. This correlation can be seen in the following chart showing the spread change between the 2 yr and the 10 yr government bonds in the US, Germany and Japan. One bright spot from the chart is that after 8 months of decreases, all three countries showed a notable tick in September which may indicate some stabilization.